A personal loan is a type of loan that is typically used for smaller purchases or debt consolidation. When you are looking for a personal loan, you will want to find the best interest rate possible. This can be a bit tricky, because interest rates vary from lender to lender.One thing to keep in mind is that the interest rate you receive on a personal loan is often dependent on your credit score. If you have a good credit score, you can expect to receive a lower interest rate. If you have a bad credit score, you may have to pay a higher interest rate. Check your credit with Personal Loan Pro to find you a matched loan option.

There are a few ways to get a lower interest rate on a personal loan. You can shop around for the best rates, or you can try to improve your credit score. You can also ask your current bank for a lower interest rate on a personal loan.

If you are looking for a personal loan, it is important to compare interest rates from different lenders. This will help you find the best deal possible.

What Is The Average Interest Rate On A Personal Loan?

When it comes to taking out a personal loan, one of the most important things to know is the interest rate. This number will tell you how much you’ll end up paying back on top of the principal loan amount, so it’s important to understand what you’re getting into.Generally, interest rates on personal loans range from about 5% to 36%. However, there are a lot of factors that go into what your interest rate will be. Your credit score is a major determinant, as is the lender you go with.

If you have excellent credit, you’ll likely qualify for the lowest interest rates. However, if your credit score is poor, you may have to pay a much higher interest rate, or may not be able to get a loan at all.

Another thing to keep in mind is that interest rates can vary depending on the amount of the loan. For example, you may pay a lower interest rate on a smaller loan amount than you would on a larger loan amount.

So, what’s the average interest rate on a personal loan? This varies depending on the lender, but typically falls somewhere between 10% and 20%. Of course, your interest rate will depend on your credit score and other factors.

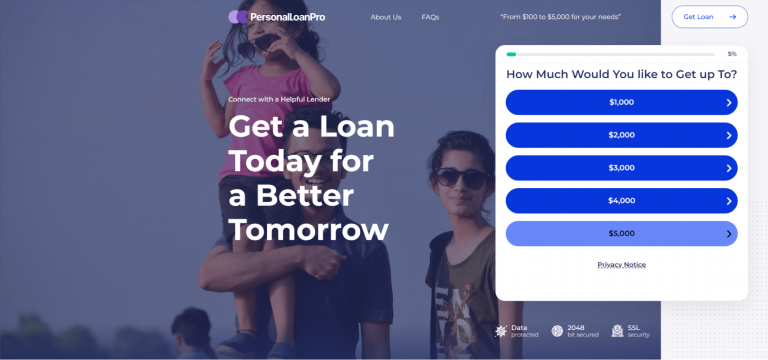

If you’re curious about what your interest rate could be, it’s best to speak with a broker. Personal Loan Pro can give you an idea of what interest rates are available to you and help you find the best loan for your needs.

What Affects Personal Loan Interest Rates?

Your credit score is a big factor in the interest rate you’ll be offered on a personal loan.If you have a good credit score, you’ll likely be offered a lower interest rate. This is because lenders believe that you’re a lower-risk borrower and are more likely to repay your loan on time.

If you have a poor credit score, you’ll likely be offered a higher interest rate. This is because lenders believe that you’re a higher-risk borrower and are more likely to default on your loan.

Other factors that can affect your interest rate include your income, your employment status, and your credit history.

If you’re looking for a personal loan, it’s important to shop around and compare interest rates. This will help you find the best deal possible.

What To Do If You’re Not Offered A Good Personal Loan Interest Rate

When you’re in the market for a personal loan, it’s important to get the best interest rate you can. If you’re not offered a competitive rate, you may want to consider looking elsewhere.Here are a few tips to help you get the best interest rate on your personal loan:

- Compare rates from multiple lenders.

It’s important to compare rates from multiple lenders to ensure you’re getting the best deal. You can use a site like LendingTree to compare rates from a variety of lenders.

- Ask for a lower interest rate.

If you’re not offered a competitive interest rate, you can always ask for a lower rate. Sometimes, a lender may be willing to negotiate on the interest rate.

- Consider a personal loan from a credit union.

Credit unions typically offer lower interest rates on personal loans than traditional banks. If you’re looking for the best interest rate, a credit union may be a good option.

- Shop around for a cosigner.

If you’re having trouble getting a loan with a competitive interest rate, you may want to consider finding a cosigner. A cosigner can help you get a loan with a lower interest rate.

- Consider a personal loan from a peer-to-peer lender.

Peer-to-peer lenders offer lower interest rates than traditional lenders. If you’re looking for a competitive interest rate, a peer-to-peer lender may be a good option.