Emergency personal loans can help you cover unexpected expenses when you need money fast. Whether you have an unexpected car repair bill, or you need to cover a last-minute trip, an emergency personal loan can help you get the money you need quickly.When you’re looking for an emergency personal loan, it’s important to know your options. There are a variety of lenders who offer emergency loans, so it’s important to compare interest rates and terms. You also want to make sure you can afford to pay back the loan quickly, so you don’t get stuck in a cycle of debt.

If you’re looking for an emergency personal loan, it’s important to shop around and compare rates. You can use a personal loan calculator to get an idea of what your monthly payments would be. You also want to make sure you can afford the loan, so you don’t get stuck in a cycle of debt.

An emergency personal loan can be a great way to cover unexpected expenses. When you’re shopping for a loan, be sure to compare interest rates and terms. You also want to make sure you can afford the loan, so you don’t get stuck in a cycle of debt.

What Is An Emergency Personal Loan?

An emergency personal loan is a loan that you can take out in a time of emergency. This loan can be used to pay for things like medical bills, car repairs, or home repairs.When you take out an emergency personal loan, you will usually need to provide proof of your emergency. This can include things like a doctor’s note or a receipt for car repairs.

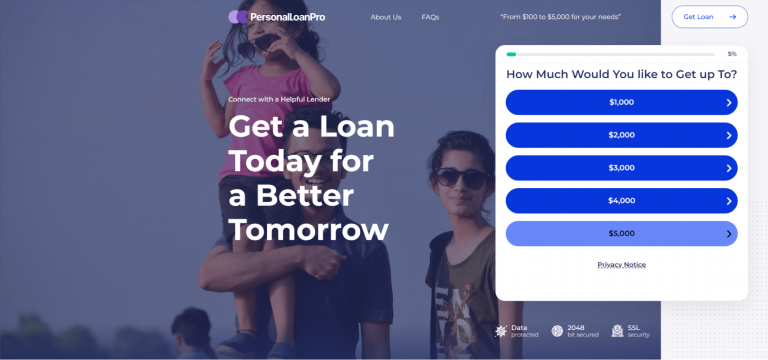

One of the benefits of an emergency personal loan is that you can usually get the money quickly. This can be helpful in a time of crisis.You can apply an emergency loan from Personal Loan Pro.

If you are thinking about taking out an emergency personal loan, be sure to shop around for the best rates. You may be able to find a loan that has a lower interest rate than a credit card.

How To Qualify For An Emergency Loan

Emergency loans are a great option for people who need money quickly and don’t have any other options. However, not everyone is eligible for an emergency loan. There are some requirements that you need to meet in order to qualify.The first thing you need to do is make sure that you meet the eligibility requirements. Most emergency loan providers require that you be a U.S. citizen or a permanent resident, and you must be at least 18 years old. You also need to have a valid bank account and a steady income.

In addition to meeting the eligibility requirements, you also need to have a good credit score. If you have a low credit score, you may still be able to qualify for a loan, but you may have to pay a higher interest rate.

To improve your chances of qualifying for an emergency loan, make sure that you meet all of the eligibility requirements and have a good credit score. If you do, you can rest assured that you’ll be able to get the money you need when you need it.

How Do I Apply For An Emergency Loan?

When you’re in a tough financial situation and you need money fast, an emergency loan may be the best option for you. These loans are designed to help people in a pinch, and they can be a lifesaver when you need money urgently.But how do you go about applying for an emergency loan? And what are the requirements you’ll need to meet? Here’s a look at what you need to know:

The first step is to find a lender that offers emergency loans. Not all lenders offer these loans, so you’ll need to do a bit of research. Once you’ve found a lender, read through their terms and conditions to make sure you meet all the requirements. Personal Loan Pro will be a good choice for you.

Some lenders may require you to be a resident of the United States, while others may require you to be employed. You may also need to have a good credit score.

In addition, you’ll likely need to provide proof of income, proof of residence, and proof of your financial situation. This could include bank statements, pay stubs, or other documentation.

Once you’ve gathered all the necessary documents, you can start the application process. This can often be done online, and you’ll typically need to provide some personal information, such as your name, address, and Social Security number.

Be sure to read through the terms and conditions of the loan before you apply, and be sure you can afford to repay the loan once it’s approved. Emergency loans can be a helpful solution in a financial emergency, but they should not be taken lightly.